Who Benefits From A Living Trust . One of the primary benefits of using a living trust is to avoid probate. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. It designates a trustee and provides explicit directions. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust is a legal arrangement used in estate planning and set up by someone during their lifetime.

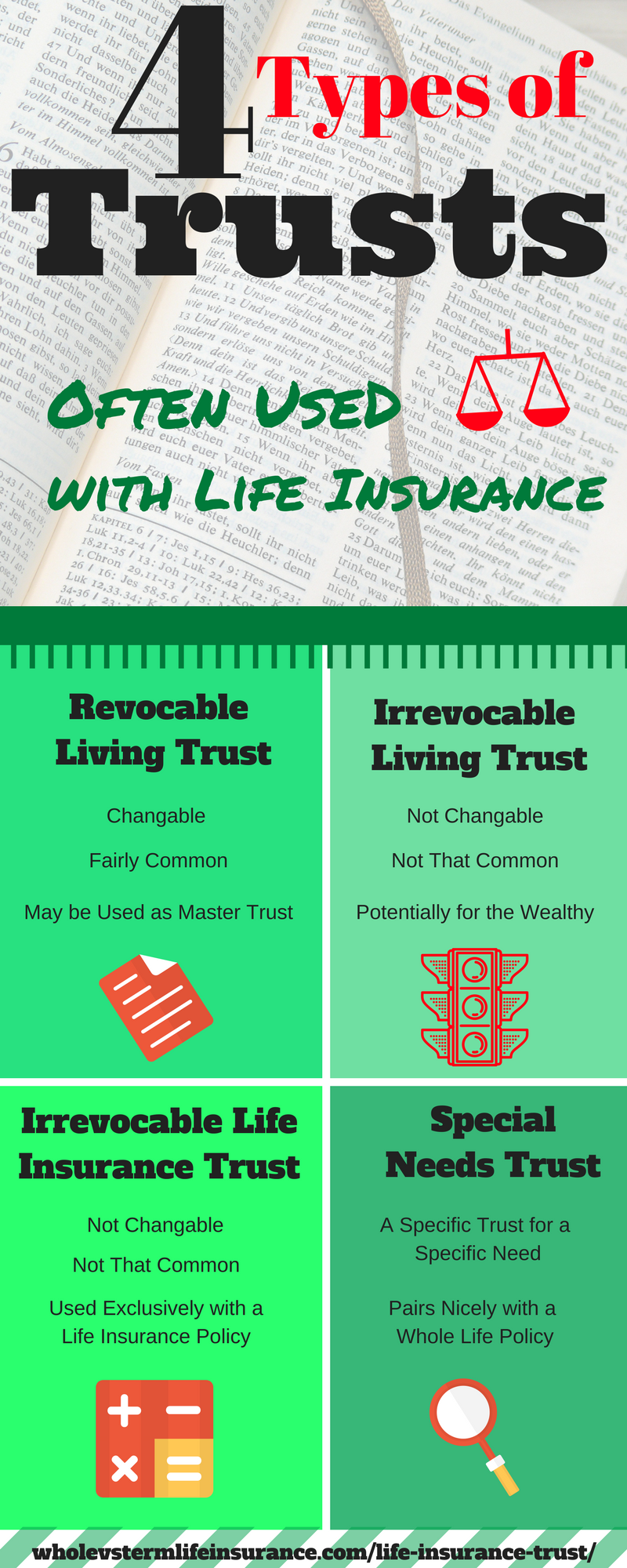

from wholevstermlifeinsurance.com

A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust is a legal arrangement used in estate planning and set up by someone during their lifetime. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. One of the primary benefits of using a living trust is to avoid probate. It designates a trustee and provides explicit directions. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive.

Life Insurance Trust Whole Vs Term Life

Who Benefits From A Living Trust It designates a trustee and provides explicit directions. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust is a legal arrangement used in estate planning and set up by someone during their lifetime. One of the primary benefits of using a living trust is to avoid probate. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. It designates a trustee and provides explicit directions. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive.

From www.hanovermortgages.com

Living Trust What Is a Living Trust + Do You Need One? Hanover Mortgages Who Benefits From A Living Trust A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust is a legal arrangement used in estate planning and set. Who Benefits From A Living Trust.

From wcstore.wealthcounsel.com

Understanding the Benefits of Living Trusts WealthCounsel, LLC Who Benefits From A Living Trust It designates a trustee and provides explicit directions. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. One of the primary benefits of. Who Benefits From A Living Trust.

From www.dreamstime.com

Living Trust VS Wills stock illustration. Illustration of consultant Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. One of the primary benefits of using a living trust is to avoid probate. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is.. Who Benefits From A Living Trust.

From www.firstnebtrust.com

Benefits of Trusts First Nebraska Trust Company Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a legal arrangement used in estate planning and set. Who Benefits From A Living Trust.

From www.financestrategists.com

Irrevocable Trust Definition, Types, and Pros & Cons Who Benefits From A Living Trust A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. One of the primary benefits of using a living trust is to avoid probate.. Who Benefits From A Living Trust.

From www.jacobicapital.com

What's the Deal with Trusts? Benefits of a Living Revocable Trust Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. One of the primary benefits of using a living trust is to avoid probate. A living. Who Benefits From A Living Trust.

From www.youtube.com

3 Top Benefits of Living Trusts [With Life Insurance] YouTube Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. One of the primary benefits of using a living trust is to avoid probate. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is.. Who Benefits From A Living Trust.

From www.gibbslawfl.com

Benefits Definition Magnifier Showing Bonus Perks Or Rewards Estate Who Benefits From A Living Trust It designates a trustee and provides explicit directions. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. One of the. Who Benefits From A Living Trust.

From www.slideshare.net

What are the Benefits of a Revocable Living Trusts Who Benefits From A Living Trust It designates a trustee and provides explicit directions. One of the primary benefits of using a living trust is to avoid probate. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a legal arrangement used in estate planning and. Who Benefits From A Living Trust.

From www.themoneyalert.com

Wills vs Living Trusts Understanding the Nuances Between the two The Who Benefits From A Living Trust One of the primary benefits of using a living trust is to avoid probate. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. It designates a trustee and provides explicit directions. A living trust, also called a revocable living trust, is a legal agreement in which. Who Benefits From A Living Trust.

From www.youtube.com

What is a Living Trust and What are the Benefits? (Living Trust 101 Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. It designates a trustee and provides explicit directions. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust is a legal. Who Benefits From A Living Trust.

From heritagereversemortgage.com

Benefits of Living Trusts Protect Your Loved Ones Heritage Reverse Who Benefits From A Living Trust It designates a trustee and provides explicit directions. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a. Who Benefits From A Living Trust.

From wholevstermlifeinsurance.com

Life Insurance Trust Whole Vs Term Life Who Benefits From A Living Trust It designates a trustee and provides explicit directions. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. A living trust is a legal arrangement used in estate planning and set up by someone during their lifetime. A living will is focused on what kinds of healthcare. Who Benefits From A Living Trust.

From hodderink.com

9 benefits of a trust SandGenLife Who Benefits From A Living Trust A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. A living will is focused on what kinds of healthcare you. Who Benefits From A Living Trust.

From www.dreamstime.com

Six Benefits of Trust stock illustration. Illustration of liability Who Benefits From A Living Trust A living trust is a legal document which places ownership and control of property into a trust, managed by a trustee for your. One of the primary benefits of using a living trust is to avoid probate. It designates a trustee and provides explicit directions. A living trust, also called a revocable living trust, is a legal agreement in which. Who Benefits From A Living Trust.

From pinkisthenewblog.com

Understanding the Benefits of a Living Trust Is it Worth the Cost Who Benefits From A Living Trust A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. It designates a trustee and provides explicit directions. One of the primary benefits of using a living trust is to avoid probate. A living trust is a legal document which places ownership and control. Who Benefits From A Living Trust.

From lawrina.com

Revocable Trust vs. Irrevocable Trust What's the Difference? Who Benefits From A Living Trust A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living will is focused on what kinds of healthcare you accept or refuse in the event of your incapacity, while a living trust is. A living trust, also called a revocable living trust, is a legal agreement in. Who Benefits From A Living Trust.

From estateplannersmarketing.com

Benefits of a Living Trust Estate Planning Attorney Design, SEO Who Benefits From A Living Trust A living trust, also called a revocable living trust, is a legal agreement in which a trustee manages assets for you and beneficiaries while you're alive. A living trust is a legal document that is used in estate planning to manage and distribute your assets after death. A living will is focused on what kinds of healthcare you accept or. Who Benefits From A Living Trust.